Pradhan Mantri Fasal Bima Yojana PMFBY

Ensuring Farmer Resilience: Pradhan Mantri Fasal Bima Yojana (PMFBY)

1. Introduction

The Pradhan Mantri Fasal Bima Yojana (PMFBY) is a crop insurance scheme launched by the Government of India in 2016.

2. Objective

- PMFBY aims to provide financial protection to farmers against crop losses due to natural calamities, pests, and diseases.

Pradhan Mantri Fasal Bima Yojana (PMFBY) aims at supporting sustainable production in agriculture sector by way of - a) providing financial support to farmers suffering crop loss/damage arising out of unforeseen events b) stabilizing the income of farmers to ensure their continuance in farming c) encouraging farmers to adopt innovative and modern agricultural practices d) ensuring flow of credit to the agriculture sector; which will contribute to food security, crop diversification and enhancing growth and competitiveness of agriculture sector besides protecting farmers production risks.

3. Key Features

- Comprehensive Coverage: Covers all food crops, oilseeds, and horticultural crops, providing comprehensive risk protection to farmers.

- Premium Subsidy: Premium rates are subsidized by the central and state governments to make insurance affordable for farmers.

- Timely Settlement of Claims: Ensures prompt settlement of claims within a specified timeframe to provide timely relief to affected farmers.

- Use of Technology: Leveraging technology for crop cutting experiments, weather data collection, and claim assessment to enhance efficiency and transparency.

- Farmer-Friendly: Farmer-friendly features such as simplified application procedures and hassle-free claim settlement processes.

What is Premium Rates and Premium Subsidy ?

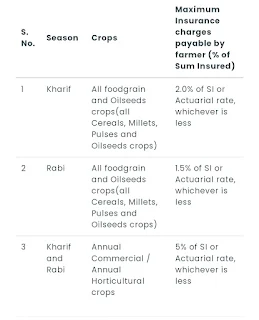

The Actuarial Premium Rate (APR) would be charged under PMFBY by implementing agency (IA). The rate of Insurance Charges payable by the farmer will be as per the following table

1.Kharif : All foodgrain and Oilseeds crops(all Cereals, Millets, Pulses and Oilseeds crops): 2.0% of Si or Actuarial rate, whichever is less

2 Robi : All foodgrain and Oilseeds crops(all Cereals, Millets, Pulses and Oilseeds crops): 1.5% of Si or Actuarial rate, whichever is less

Premium Rates in PMFBY

Kharif crops :2%

Rabi crops :1.5%

Commercial crops/Horticultural crops: 5%

3 Kharif and Rabi Annual Commercial / Annual Horticultural crops : 5% of Si or Actuarial rate, whichever is less

4. Impact

- Risk Mitigation: PMFBY has helped in mitigating the financial risks associated with crop failures, thereby safeguarding farmers' livelihoods.

- Increased Confidence: Enhanced confidence among farmers to adopt modern agricultural practices and invest in high-yielding crop varieties.

- Financial Stability: Provides financial stability to farmers and their families during times of crop losses, reducing the distress faced by rural households.

- Stimulating Investments: Encourages farmers to invest in agricultural inputs and technologies, leading to increased agricultural productivity and income.

5. Challenges and Solutions

- Awareness and Outreach: Limited awareness among farmers, especially in remote and marginalized areas. Solution: Intensified awareness campaigns and extension services at the grassroots level.

- Data Accuracy: Challenges in data collection and validation for accurate assessment of crop losses. Solution: Strengthening the monitoring and evaluation mechanisms and leveraging technology for data management.

- Timely Premium Payment: Delays in premium payment by farmers and government agencies. Solution: Streamlined premium payment processes and incentivizing timely premium payments through discounts or rebates.

6. Conclusion

- Pradhan Mantri Fasal Bima Yojana serves as a crucial safety net for farmers, providing them with much-needed financial protection against crop losses.

- It plays a significant role in enhancing the resilience of Indian agriculture to withstand natural calamities and climatic uncertainties.

- Continued efforts are needed to address implementation challenges and ensure the effective functioning of PMFBY in safeguarding the interests of farmers.

7. Future Outlook

- Technology Integration: Further leveraging technology for remote sensing, satellite imagery, and blockchain to improve the accuracy and efficiency of crop insurance operations.

- Customized Risk Management Solutions: Tailoring insurance products to address the specific needs and vulnerabilities of different crop-growing regions and farming communities.

- Strengthening Partnerships: Collaborating with insurance companies, banks, and agricultural stakeholders to enhance the reach and effectiveness of crop insurance schemes.

Friends, how did you like this article, you will definitely tell in the comment section and thank you for visiting our website continuously to get such articles.

Join my Teligram channel - Click here

Join my whatsapp group -Click here

https://agaxndarejeetfix.blogspot.com/2024/05/pradhan-mantri-fasal-bima-yojana-pmfby.html

ReplyDelete